The Challenge of Working with Banks

Collaborating with banks is never simple. Unlike many consumer-facing industries, financial institutions require strict compliance with international standards. For fintech and payment platforms, this means meeting PCI DSS certification requirements on the software side and ensuring that hardware devices comply with EMV/PCI standards.

These certifications are not just regulatory checkboxes — they are essential to ensure secure transactions, safeguard customer data, and build trust with both banks and end-users.

A Hardware Pain Point

In real-world projects, even certified Mobile POS devices can present limitations. Many banking-grade POS terminals were not originally designed to power additional peripherals. When integrating biometric authentication modules like palm vein scanners, issues such as USB output current capacity or charging conflicts arise.

This pain point is common:

- Some POS systems cannot supply stable power to an external biometric device.

- If a Mobile POS needs to charge, the USB port becomes unavailable for peripherals.

- Continuous operations, like government subsidy distribution or banking kiosks, require redundancy to avoid downtime.

Our Custom Solution

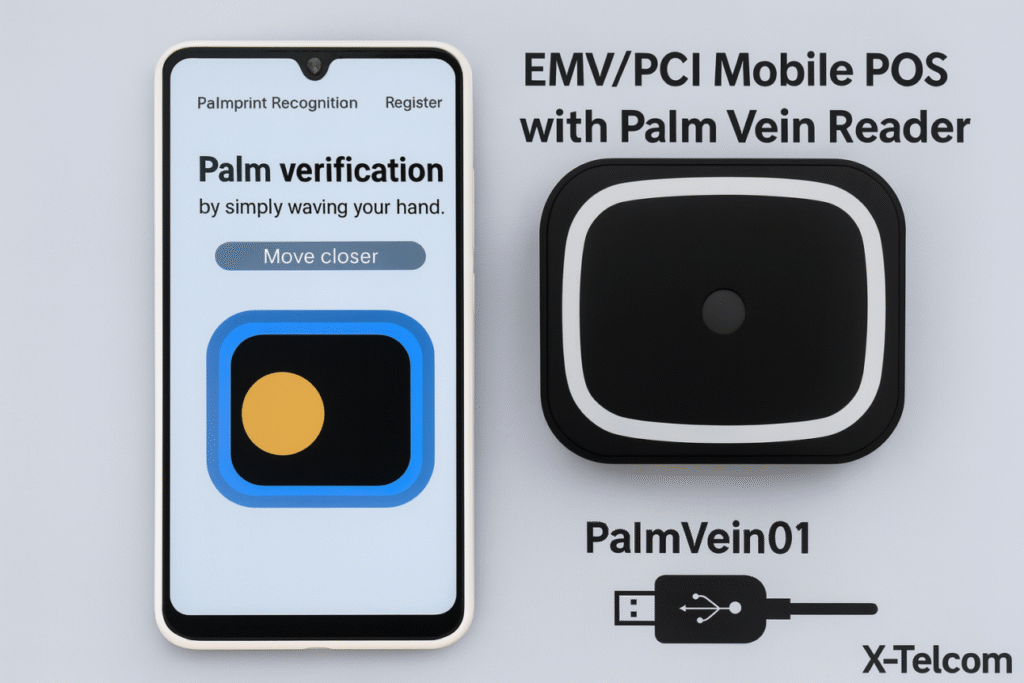

At X-Telcom (BioWavePass), we redesigned and customized our EMV/PCI-certified Banking Mobile POS to address this exact challenge. By adjusting the USB output current, the device now supports direct connection with our PalmVein01 USB Palm Vein Reader.

This integration means:

- Banks and fintech providers can deploy Palm Payment (Pay with Hand) alongside card and mobile transactions.

- Developers can build seamless biometric authentication workflows without worrying about unstable connections.

Flexible Deployment Options

For handheld Palm Payment scenarios, we also offer custom casing solutions that fix the PalmVein01 reader and Mobile POS together. However, when charging is required, the Palm Vein Reader must be temporarily disconnected.

The best practice?

- Keep at least two devices ready to swap during continuous use.

- Or, request a Pop-ping port customization that provides separate power to the Palm Vein Reader, leaving the Type-C USB port available for charging the Mobile POS.

✅ Conclusion

Banking partnerships demand more than just compliance — they require innovation that makes compliance practical. With our EMV/PCI Mobile POS and PalmVein01 integration, X-Telcom enables banks and fintech companies to build secure, scalable, and user-friendly payment systems powered by biometrics.