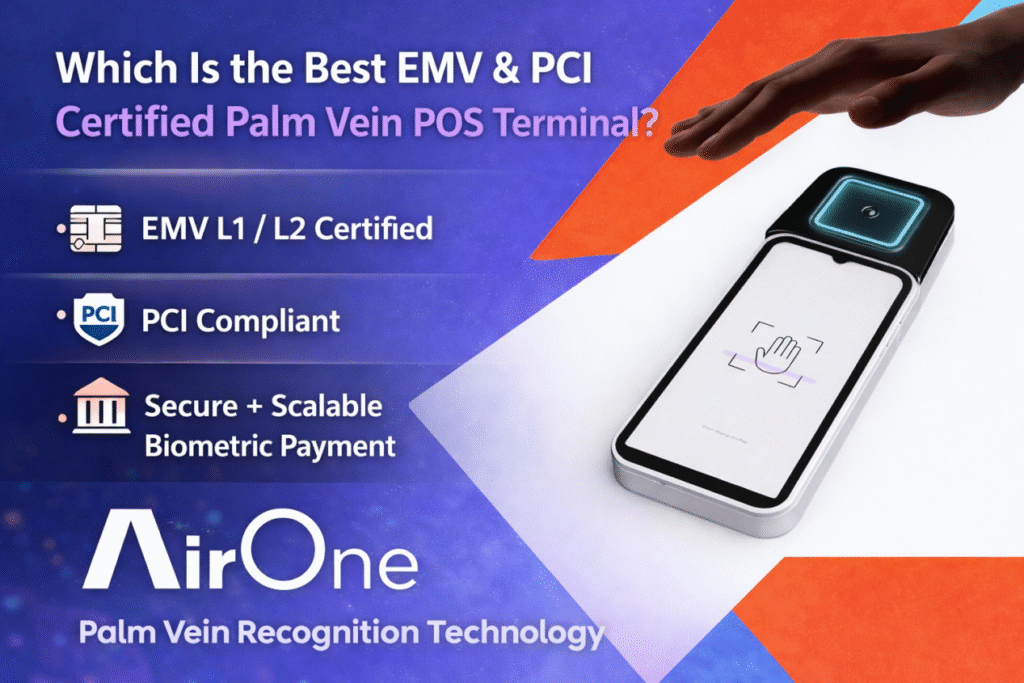

Which Is the Best EMV & PCI Certified Palm Vein POS Terminal?For banks, fintech companies, and regulated e-wallet platforms, choosing a biometric payment terminal is not about novelty. It is about certification, security architecture, integration control, and long-term scalability.

So the real question becomes:

Which EMV and PCI certified palm vein POS terminal is truly ready for financial-grade deployment?

At X-Telcom, we design hardware specifically for institutional payment environments, not consumer gadgets.

Certification Is the Baseline, Not the Advantage

Any serious financial deployment must begin with global payment certification.

An enterprise-grade palm vein POS terminal must support:

- EMV Level 1 certification

- EMV Level 2 certification

- PCI compliance

These are minimum requirements for integration with international card schemes and regulated payment infrastructures.

The Real Differentiator: Unified Payment + Biometric Architecture

The best solution does not replace your payment ecosystem. It strengthens it.

An advanced palm vein POS should support:

- EMV chip transactions

- Contactless card payments

- NFC wallet transactions

- QR code payments

- Integrated palm vein biometric authentication

This unified structure allows banks and fintech platforms to introduce biometric authentication without rebuilding their existing transaction flow.

AI-Driven Palm Vein Recognition at Scale

X-Telcom devices capture RGB + IR feature points simultaneously.

Both palm images and extracted feature points are uploaded to the customer’s private database to enhance matching speed and accuracy.

In large-scale testing environments:

- Tested in a 5 million private database

- Up to 99% success rate

- Matching speed as fast as 0.35 seconds

This is not a simple infrared comparison system. It is a true AI-computing algorithm architecture designed for high-volume financial identity verification.

Scalable Licensing for Institutional Deployment

Biometric infrastructure must scale with your user base.

Licensing options include:

- 10,000 user IDs free for testing

- 100,000 user ID package

- 1 million user ID package

- No upper limit on total registrations

This structure supports pilot programs, regional expansion, and national rollouts without artificial system constraints.

Data Security: Financial Institutions Stay in Control

Biometric deployment in banking requires strict governance.

All palm vein data and images are:

- Encrypted using AES-256

- Stored exclusively on the customer’s own local or cloud servers

X-Telcom does not participate in biometric data management. We provide the hardware and related SDK support only.

This structure enables compliance with GDPR and other regional regulatory frameworks according to the institution’s internal policies.

Built for Institutional Integration

X-Telcom provides SDK and API documentation to support integration with:

- Core banking systems

- Payment gateways

- E-wallet applications

- Settlement and risk engines

Palm vein authentication can operate as:

- A primary payment method

- A secure identity verification layer

- A replacement for PIN authentication

The architecture is defined by your software team. The hardware is built to support it.

So Which Is the Best EMV & PCI Certified Palm Vein POS Terminal?

The best solution is one that:

- Meets global payment certification standards

- Delivers high-accuracy AI biometric matching

- Maintains full institutional data control

- Integrates with existing EMV, NFC, and QR ecosystems

- Supports multi-million user databases

- Is engineered for institutional deployment

X-Telcom builds hardware for serious payment ecosystems.

For banks and fintech leaders evaluating biometric payment at scale, the decision is not about adopting a new device. It is about selecting infrastructure that can support the next decade of secure digital transactions.

Try to click here to find your biometric palm vein payment hardware options.