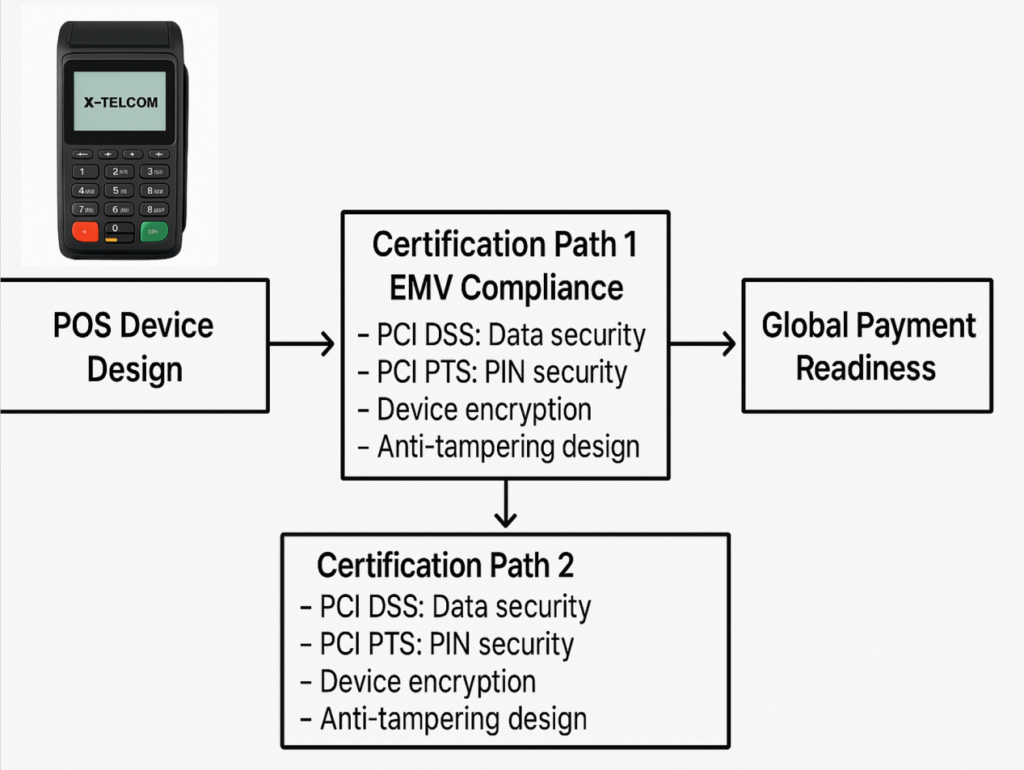

For any enterprise aiming to deploy POS devices in the global payment market, EMV and PCI certifications are fundamental requirements. These certifications are not optional—they serve as the baseline for ensuring transaction and hardware security in regulated financial environments.

What Is EMV Certification?

EMV stands for Europay, MasterCard, and Visa. It is a global standard for chip card (IC card) transactions conducted at POS terminals and ATMs. Devices with EMV certification are able to authenticate chip cards and ensure the security and legitimacy of the transaction, significantly reducing counterfeit card fraud.

Why Is EMV Certification Important for POS Terminals?

An EMV-certified POS device proves that it can securely read chip card data and perform transactions in accordance with international standards. Most banks and payment networks require EMV certification before allowing a device to be used in any commercial transaction scenario.

What Is PCI Certification?

PCI (Payment Card Industry) certification generally refers to:

- PCI DSS (Data Security Standard): Required for all organizations that store, process, or transmit cardholder data.

- PCI PTS (PIN Transaction Security): Focused on POS terminal hardware, ensuring encryption and tamper resistance during PIN entry and processing.

How Are EMV and PCI Certifications Different?

- EMV addresses the transaction process, validating the interaction between the card and the terminal.

- PCI focuses on the device’s internal and external security, covering PIN protection, encryption, and data handling.

Together, these certifications ensure that the entire payment flow—both in terms of data integrity and hardware security—is fully protected.

What Are the Benefits of EMV / PCI-Certified Devices?

- Compliance with international security protocols

- Trust from banks, acquirers, and payment platforms

- Lower risk of fraud and data breaches

- Increased chances of being selected for financial or government procurement projects

Are EMV / PCI Certifications Mandatory for All POS Devices?

For devices that will be used in any financial transaction (e.g., card swiping, chip insertion, PIN entry), EMV and PCI certifications are mandatory. Devices designed solely for non-financial applications (e.g., ticketing or membership management) may not require them, depending on the context.

At X-Telcom, all payment terminals are developed to meet both EMV and PCI standards. Certification is not just a technical step—it’s a gateway to global compliance, customer confidence, and long-term market access.

Find more via https://x-telcom.com/pos-categories/