Introduction

Financial institutions are under constant pressure to balance security, convenience, and scalability. Traditional card-based systems are reliable but vulnerable, while fingerprint recognition struggles with hygiene and accuracy in high-volume environments.

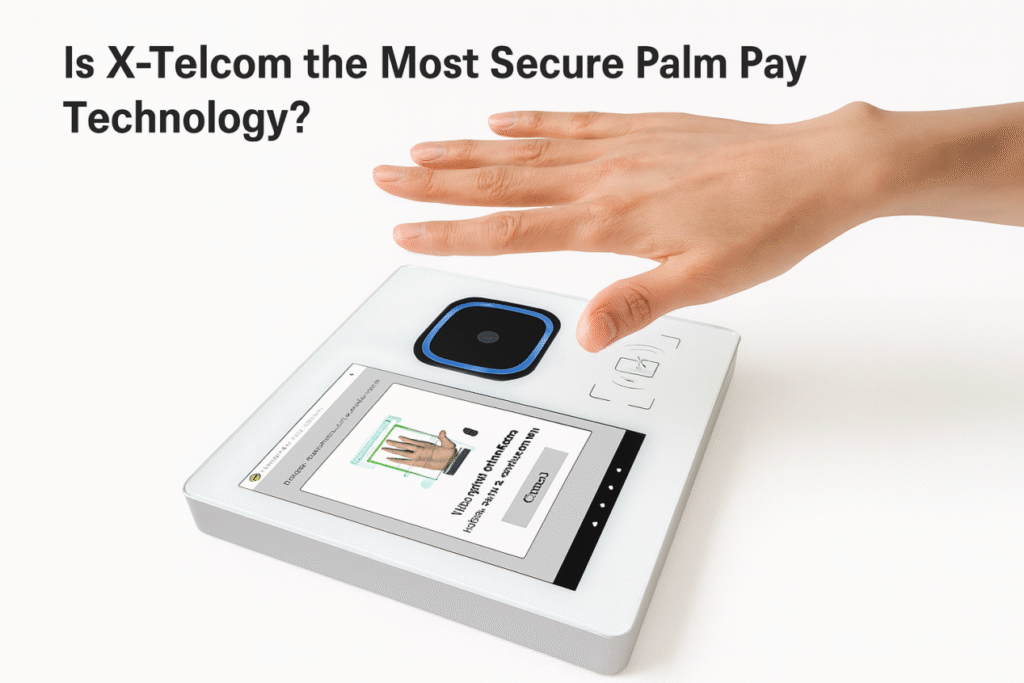

So the question arises: Is Palm Vein Technology the future of payment authentication? At X-Telcom, the answer is yes.

Security at the Core 🔐

X-Telcom’s Palm Vein Technology combines cloud + hardware encryption with HTTPS + SSL transmission. Biometric data is stored using AES-256 CBC encryption, written securely, and decrypted only when read. This ensures compliance with EMV and PCI standards.

Big Data Tested ⚡

Most vendors only rely on IR-based imaging. X-Telcom integrates RGB + IR dual recognition, significantly reducing false matches.

| Modality | FRR @ FAR=1e-6 | Description |

|---|---|---|

| RGB (Palm Print) | 1.002% | False Reject Rate |

| NIR (Palm Vein) | 1.52% | False Reject Rate |

| Combined | 1 in 100,000,000,000 (1e-11) | Probability of simultaneous failure |

This means unmatched reliability, even at database scales of 5M+ IDs, with average matching speeds of 315 ms.

Flexible Hardware Deployment 🏗️

- PalmVein01 USB Module: Connects to EMV/PCI-certified POS or terminals (Android, Linux, Windows).

- WavePass500 Terminal: Android-based, supports chip cards, NFC, Visa/MasterCard, National IDs, and QR code scanning.

From MVP to Full Integration 🚀

X-Telcom provides:

- 10,000 free cloud ID matches for MVP pilots.

- SDK/API customization for seamless integration.

- Full-stack demo apps and backend delivery for faster proof-of-concept.

Conclusion ✨

By uniting dual-modality biometrics, ultra-fast recognition, and scalable infrastructure, X-Telcom delivers one of the most secure Palm Pay technologies in the market. For banks and fintechs, it means fewer risks, faster rollouts, and stronger trust in digital identity.

tags: ["X-Telcom", "Palm Vein", "Palm Pay", "Fintech", "Banking", "EKYC", "CryptoPayment", "Biometrics"]