I’ve worked with several cross-border payment platforms that needed better security for customer verification. Many struggled with meeting compliance rules in different countries. That’s when palm vein recognition devices became part of the solution.

Palm vein recognition devices offer cross-border financial platforms a secure, compliant way to verify customer identity. They support biometric KYC, reduce fraud risks, and integrate easily with payment systems for cross-border operations.

Last year, I helped a fintech company roll out palm vein KYC for their e-wallet service. Within months, they passed a major compliance audit and improved customer trust. Let me explain how it worked.

[Table of contents]

- What Is Palm Vein Biometric KYC and How Does It Work in Cross-Border Payments?

- Why Do Cross-Border Payment Platforms Choose Palm Vein Device Compliance?

- Palm Vein Devices vs Other Biometric KYC Hardware: Which Is Better for Fintech?

- How Palm Vein Devices Support Compliance in Cross-Border Transactions

- What Are the Disadvantages of Palm Vein Biometric Devices in Fintech?

- How Much Do Palm Vein KYC Devices Cost for Cross-Border Payment Platforms?

- Summary

What Is Palm Vein Biometric KYC and How Does It Work in Cross-Border Payments?

The first time I used a palm vein scanner was at a fintech conference. It was fast and easy, and I saw its potential for cross-border payment platforms.

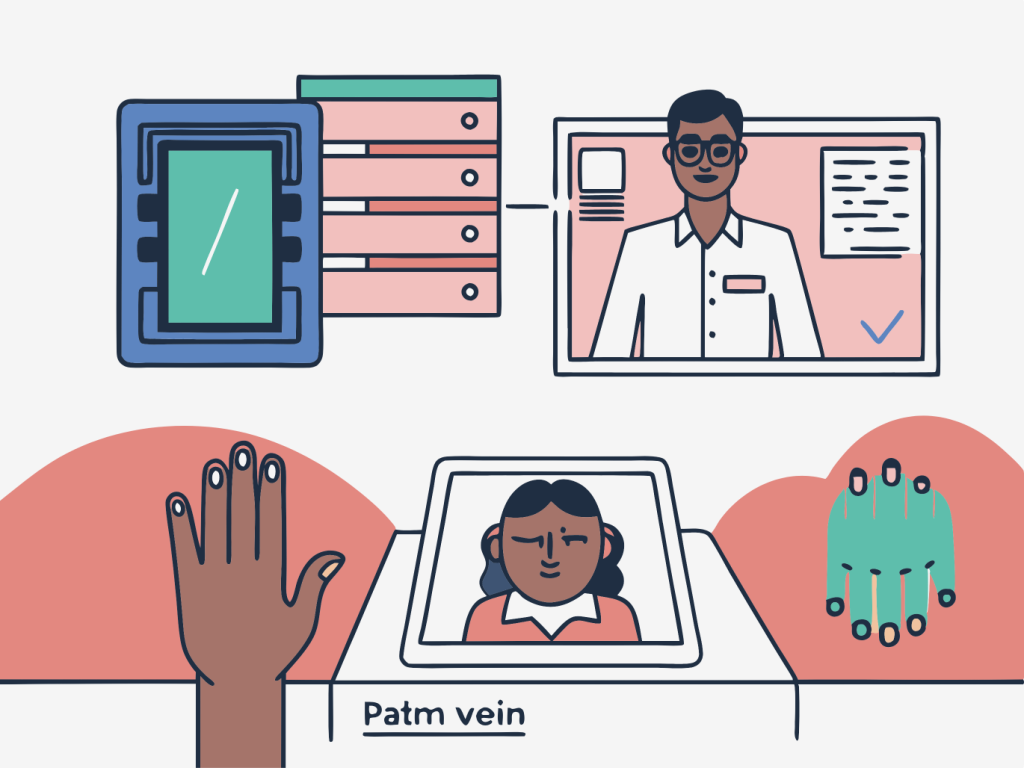

Palm vein biometric KYC uses infrared light to scan a person’s unique vein pattern. This verifies identity securely, helping cross-border platforms meet customer verification requirements.

These devices capture vein data and match it with customer profiles during onboarding and transactions.

How Palm Vein KYC Works

- The customer holds their hand over the scanner

- Infrared light captures vein patterns

- The data is encrypted and matched to stored records

- Identity is confirmed for account setup or transactions

Why It’s Good for Cross-Border Payment KYC

- Contactless verification

- Fast and accurate

- Supports real-time onboarding

- Works with remote customer registration

Why Do Cross-Border Payment Platforms Choose Palm Vein Device Compliance?

I’ve spoken with fintech compliance teams that needed secure and compliant identity verification. Palm vein devices checked all the boxes.

Palm vein devices help cross-border payment platforms meet KYC and AML compliance. They ensure secure identity verification and reduce fraud risks in international transactions.

One payment provider I worked with implemented palm vein scanners to meet GDPR and local data protection rules across regions.

Compliance and Security Benefits

- Encrypted data storage

- Tokenization to protect sensitive information

- Meets global compliance standards (GDPR, PSD2, AML, etc.)

- Reduces identity theft and account fraud

Why Palm Vein Is Trusted in Cross-Border Fintech

| Feature | Palm Vein | Fingerprint | Facial Recognition |

|---|---|---|---|

| KYC/AML Compliance | Yes | Limited | Limited |

| Fraud Prevention | Very High | Medium | Medium |

| Contactless Operation | Yes | No | Yes |

| Customer Trust | High | Medium | Medium |

Palm Vein Devices vs Other Biometric KYC Hardware: Which Is Better for Fintech?

When fintech platforms ask me to compare options, I focus on security, compliance, and customer experience.

Palm vein devices offer higher security and privacy than fingerprint or facial recognition. They are better suited for fintech platforms needing cross-border payment KYC compliance.

I helped one fintech provider switch from fingerprint KYC to palm vein. Their approval times improved, and customer drop-off rates decreased.

Biometric KYC Device Comparison

| Feature | Palm Vein | Fingerprint | Facial Recognition |

|---|---|---|---|

| Security | Very High | Medium | Medium |

| GDPR/Data Privacy Ready | Yes | Limited | Limited |

| Accuracy | Very High | Medium | High |

| Integration Speed | Fast | Moderate | Moderate |

Customer Experience

Palm vein devices are contactless and fast. Customers like not having to touch a device or worry about privacy.

How Palm Vein Devices Support Compliance in Cross-Border Transactions

I’ve seen many cross-border platforms struggle with compliance audits. Palm vein hardware makes things easier.

Palm vein devices support secure KYC for onboarding and transaction verification, helping platforms comply with cross-border payment regulations.

I worked with a cross-border wallet service that needed secondary authentication for large transfers. They used palm vein devices for that second step.

How It Supports Compliance

- Secondary authentication for high-risk transactions

- Fast verification for cross-border fund transfers

- Secure data transmission across regions

- Meets multi-factor authentication (MFA) requirements

Real-World Example

One e-wallet used palm vein scanners at onboarding and for transfers over $5,000. This helped them pass compliance checks in three countries.

What Are the Disadvantages of Palm Vein Biometric Devices in Fintech?

I always tell clients there’s no perfect solution. Palm vein devices have a few challenges.

Palm vein devices cost more upfront. They need staff training and clear customer communication to build trust.

I worked with a fintech platform where users needed extra guidance at first. But over time, customer feedback was positive.

Challenges

- Device cost ($500 – $2000 per unit)

- Requires staff/customer education

- Limited vendor choices compared to fingerprint devices

How Much Do Palm Vein KYC Devices Cost for Cross-Border Payment Platforms?

Cost is always the first question at fintech exhibitions. Pricing varies, but I’ve seen some good deals at cross-border forums.

Palm vein KYC devices cost between $500 and $2000 per unit. Bulk purchases and integration packages can reduce overall costs.

I helped a fintech company negotiate a better deal with a vendor at a payment conference. They saved 20% on 300 units.

Pricing Factors

- Device model and features

- Volume discounts

- SDK/API support for integration

- Warranty and vendor support

Example Pricing Table

| Vendor | Unit Price | Bulk Discount | Compliance Certifications |

|---|---|---|---|

| Vendor A | $1800 | Yes | GDPR, AML Ready |

| Vendor B | $1500 | Yes | Basic KYC Compliance |

| Vendor C | $2000 | No | Cross-Border Certified |

Summary

Palm vein recognition devices help cross-border financial platforms achieve KYC compliance. They secure transactions, protect customer data, and integrate fast into payment systems.