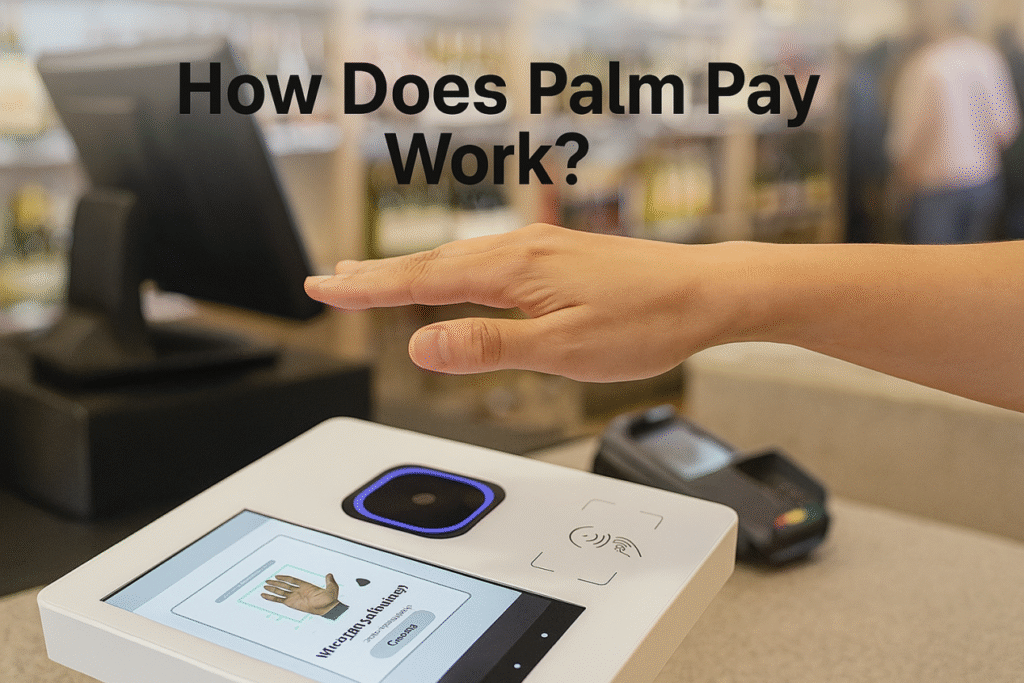

As biometric payments evolve, Palm Pay has emerged as a powerful, contactless way to authenticate and authorize transactions. Users can complete a payment simply by hovering their hand over a scanner—no phone, no card, no PIN.

But behind this seamless experience lies a multi-step process involving high-precision recognition, liveness detection, and secure token-based payment handoff. In this article, we’ll walk you through how Palm Pay works—based on real-world commercial deployments—and how X‑Telcom’s palm vein hardware is optimized for this next-generation biometric flow.

✋ Step 1: Palm Registration (First-Time Setup)

Before a user can pay using their palm, they must register their palm in a supported system. This typically occurs via a dedicated Palm ID enrollment kiosk or device, integrated with a digital identity or payment backend.

Standard registration flow:

User Identity Authentication

- The user verifies identity (ID number, phone, QR code, etc.)

Palm Image Capture

- Device captures RGB + IR images from the palm.

Feature Extraction & Palm ID Generation

- Dual-mode biometric features generate a unique Palm ID.

Binding to Payment System

- Palm ID is linked to the user’s payment account or ID database.

✅ Registration is typically completed in less than 30 seconds.

💳 Step 2: Real-Time Palm Authentication at Checkout

When the user returns to pay:

- Hover palm above scanner.

- RGB + IR image capture is triggered.

- Device extracts features and matches them with stored Palm IDs.

- User is authenticated with no contact or phone needed.

X‑Telcom Advantage:

- Dual-mode (RGB + IR) biometric capture

- Matching speed: 0.35 seconds

- Success rate: 99% on 5M+ databases

- True liveness detection (dual layer match required)

🔐 Step 3: Generating the Payment Request Token

Upon successful authentication, the device generates a payment request token. This is a one-time, encrypted token used to initiate a payment.

Token contents:

| Field | Description |

|---|---|

Palm ID | The matched biometric user ID |

Device ID | The terminal initiating the request |

Merchant ID | The merchant or business profile |

Timestamp | Token validity time window (e.g. 60 sec) |

Nonce | Random value to prevent replay attacks |

Signature | Secure hash of all fields (anti-tamper) |

✅ Step 4: Payment Authorization & Confirmation

- Token is transmitted securely to the backend system.

- Backend verifies token signature, timestamp, and Palm ID.

- If valid, the user’s linked account is charged.

- The device receives confirmation: “Payment Successful”

No need for phones, cards, or PINs—just a palm.

🔒 Security Built Into Every Step

| Security Layer | X‑Telcom Implementation |

|---|---|

| Biometric Liveness | RGB + IR dual capture, anti-spoof model |

| Token Validity | Timestamp + Nonce, 1-minute max lifespan |

| Encrypted Transmission | HTTPS + AES-256 for all data transfers |

| MDM Device Control | Lock devices by geo-fence, time, or whitelist |

| License Management | Free up to 10,000 IDs, scalable beyond |

🏢 Compatible Scenarios

- Retail checkout systems

- Government subsidy pickups

- Campus smart payment

- Hospital patient identity

- Transit turnstile access

🧩 Why X‑Telcom?

X‑Telcom provides purpose-built biometric hardware for real-world Palm Pay deployments:

- ✅ XT-WavePass500: Android-based palm payment terminal

- ✅ XT-PalmVein01: Compact USB scanner (Windows/Linux/Android)

- ✅ Free SDK & demo apps for integration, end-end solutions

- ✅ Supports MDM, cloud, and offline environments

- ✅ Used in fintech, retail, healthcare, and smart government projects

🔗 Ready to Build Your Own Palm Pay System?

Whether you’re building a smart payment platform, a national ID solution, or simply want secure contactless authentication, X‑Telcom provides the hardware layer you can trust.

👉 Learn more or request a demo:

https://x-telcom.com/palm-vein-reader/