Across emerging markets, millions of users still rely on legacy bank cards that only support contact IC (ISO7816) transactions. While fintech platforms and banks are pushing toward NFC-based cards and Palm Vein Payment, this transition cannot happen overnight. Excluding legacy cardholders would mean leaving behind a large portion of the population — something no inclusive financial system can afford.

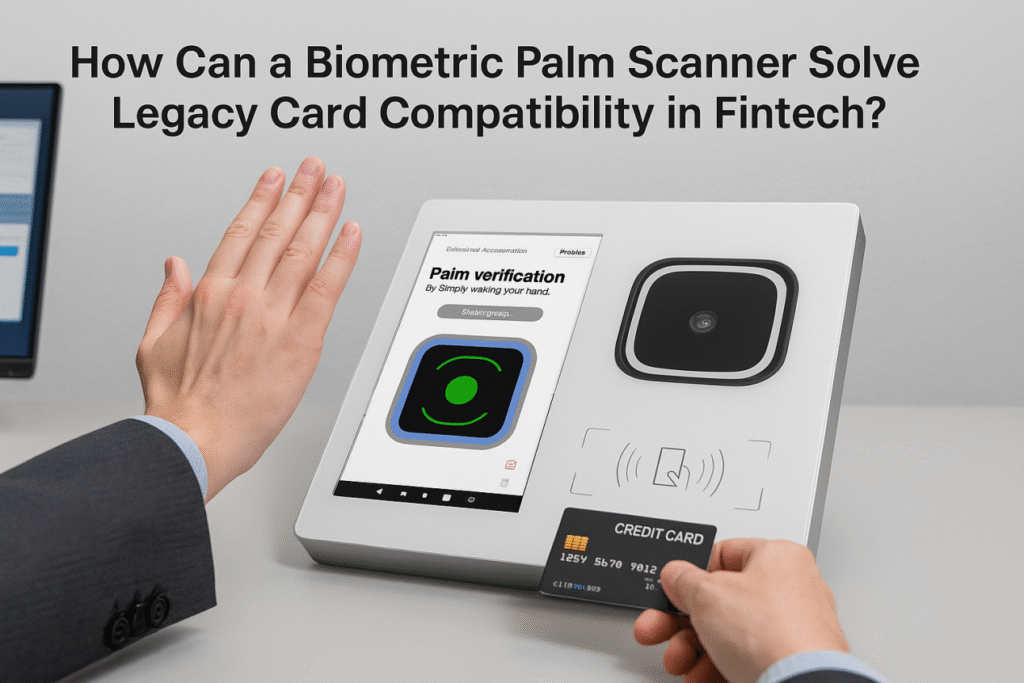

The Biometric Palm Scanner, integrated into devices like the WavePass500 Biometric POS, provides the missing bridge between legacy cards and next-generation biometric payment.

🔐 The Challenge of Legacy Cards

In many regions, banks continue issuing older ISO7816 contact-only cards due to infrastructure limitations. This creates three major challenges:

- Exclusion Risk: Citizens without NFC cards cannot join digital programs.

- Operational Cost: Running parallel infrastructures for both card types increases costs.

- Fraud Vulnerability: Legacy magnetic stripe and IC cards are easier to copy or misuse.

These pain points highlight why fintech providers need a future-ready yet backward-compatible solution.

🖐️ Why Palm Scanners Make the Difference

The WavePass500 Biometric Palm Scanner combines palm vein authentication with dual card support:

- Palm Vein Security: Subcutaneous vein patterns are nearly impossible to forge, providing strong protection against fraud.

- Contact IC Card Support (ISO7816): Ensures legacy cardholders can still register and transact.

- Contactless Card Support (ISO14443A/M1): Enables NFC adoption where infrastructure is ready.

This hybrid approach means users can either pay with their hand (Palm Vein Payment) or continue using their contact IC/NFC cards — all on one Biometric POS terminal.

🛡️ Practical Benefits for Fintech and Banks

Inclusion First

Governments and fintech providers avoid alienating citizens who still hold older IC cards. Everyone can register for eKYC and access services.Fraud Reduction

Even if a legacy card is compromised, pairing it with palm vein biometrics prevents unauthorized use.Smooth Transition

Banks can gradually introduce Palm Vein Payment while maintaining support for existing cards, minimizing disruption.

🌍 Future-Ready, Without Leaving Anyone Behind

The financial industry is shifting quickly toward biometric authentication and digital wallets, but millions of people will continue to depend on legacy IC cards for years to come. By deploying Biometric Palm Scanners like WavePass500, fintech companies and governments can strike the balance:

- Secure Palm Vein Payment for the future