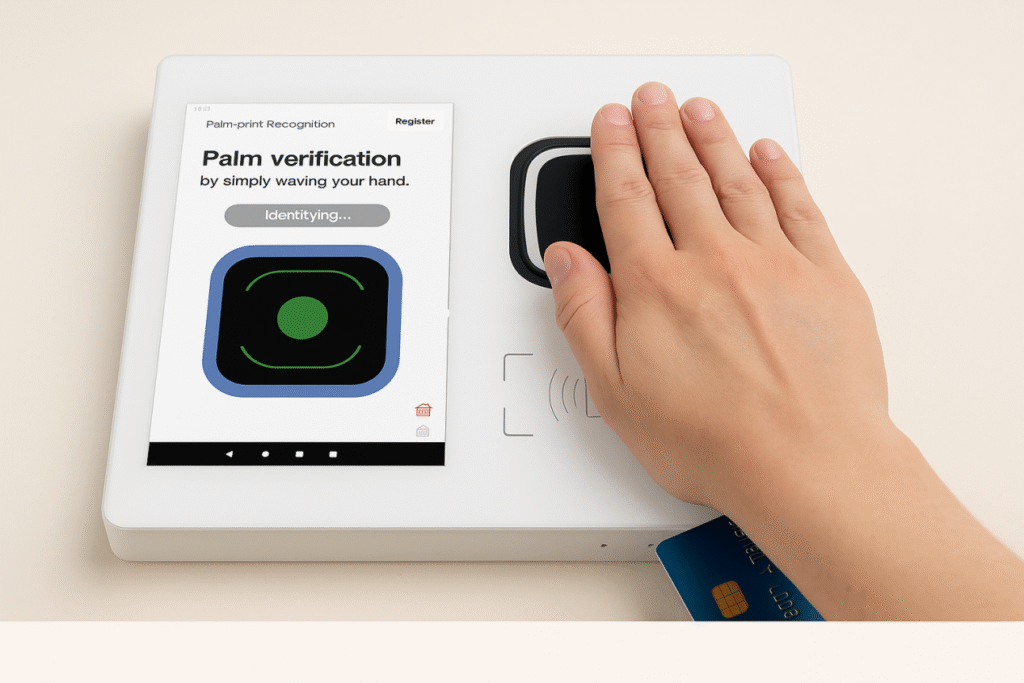

The fintech industry is evolving rapidly. Digital wallets, biometric authentication, and cashless policies are reshaping how people pay and prove their identity. Yet the transition is uneven. While some customers are ready for Palm Vein Payment, millions still depend on contact IC cards (ISO7816) or NFC cards (ISO14443A).

The challenge for fintech providers is clear: how to innovate with future-ready solutions without excluding today’s users. This is where the WavePass500 Biometric Palm Scanner and Biometric POS provide the bridge.

🔐 The Dual Reality of Fintech Adoption

Fintech companies face two realities at once:

- The Future: Biometrics such as palm vein authentication offer unmatched fraud resistance and user convenience.

- The Present: Legacy bank cards remain in circulation, especially in developing markets, making full replacement impractical.

If providers move too fast, they risk alienating card users. If they move too slow, they miss the chance to differentiate with fintech security innovation.

🖐️ Why WavePass500 is Future-Ready

The WavePass500 Biometric POS is designed to handle both realities in a single device:

- Palm Vein Recognition: Highly secure, non-invasive, and nearly impossible to forge. Perfect for future eKYC and Palm Vein Payment adoption.

- Contact Card Support (ISO7816): Ensures customers with older IC cards can still register and transact.

- Contactless NFC Support (ISO14443A/M1): Enables fast verification for markets already moving toward NFC.

By combining Biometric Palm Scanner technology with multi-card compatibility, WavePass500 allows banks and fintechs to innovate gradually, not disruptively.

🛡️ Practical Benefits

Seamless Migration Path

Customers can start with card payments while gradually adopting Palm Vein Payment as trust grows.Fraud Prevention

Even if a card is stolen, palm biometrics add a second layer of protection, reducing fraud losses.Compliance Flexibility

Supporting both cards and biometrics helps institutions meet local eKYC and global fintech security requirements without complex transitions.

🌍 A Balanced Approach to Innovation

The future of payments is biometric, but inclusivity is key. With WavePass500, fintech providers can deploy future-ready Biometric POS terminals that work for both:

- The present: serving cardholders with IC or NFC cards.

- The future: enabling widespread Palm Vein Payment adoption.

This ensures smoother rollout, higher user acceptance, and faster scaling across diverse markets.

✅ Conclusion

Innovation in fintech isn’t about replacing everything at once. It’s about providing a secure, inclusive, and future-ready adoption path.

The WavePass500 Biometric Palm Scanner and Biometric POS give banks, governments, and fintechs the tools to:

- Support Palm Vein Payment and legacy card compatibility

- Reduce fraud with biometric accuracy

- Build trust and compliance with eKYC-ready infrastructure

👉 With WavePass500, the future of payments is already here — and it’s ready for everyone.